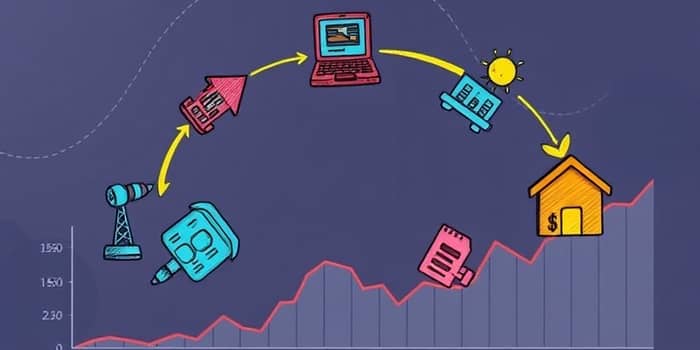

Sector rotation is an investment approach that moves capital between industry groups as economic conditions evolve. By anticipating shifts in growth drivers, investors can position themselves to capture returns ahead of the broader market.

Sector rotation is an active investing strategy based on the observation that different segments of the stock market shine during different times. By grouping companies into sectors like technology, health care, and energy, investors can reposition capital to the areas poised for growth as the economy changes.

This approach contrasts with passive investing, offering potential for enhanced returns but requiring ongoing research, quick decision-making. For those willing to stay vigilant, sector rotation can unlock hidden opportunities when markets shift.

The stock market typically moves in tandem with the broader business cycle, which unfolds in four stages: recession, recovery, expansion, and contraction. Each phase affects industries differently, leading to a phase-shifted performance cycle across sectors.

Understanding how sectors correlate with economic phases is key to anticipating which areas will outperform.

These tendencies are driven by changing consumer behavior, corporate spending, and policy responses.

Sector returns are influenced by macro factors such as interest rates, commodity prices, and consumer confidence. In recessions, investors seek safety in companies that deliver basic goods and services, creating stable demand for defensive sectors. As the economy recovers, cyclical industries respond to renewed spending, fueling gains.

The shift in capital flows follows predictable patterns as policymakers adjust monetary stance and corporations revise earnings guidance.

Effective sector rotation relies on disciplined timing and top-down analysis. Investors must interpret data and adjust allocations at appropriate intervals rather than chasing recent winners.

Consistent monitoring of economic releases—such as nonfarm payroll data or ISM manufacturing reports—enables timely adjustments. Pairing market sentiment indicators with quantitative models can further refine entry and exit points.

Data-driven investors leverage a suite of analytical instruments to guide sector rotation decisions. Comparing the S&P 500 to its Equal Weight Index, for example, reveals whether gains are concentrated or broad-based.

Recent trends as of July 2025 show shifts from mega-cap technology into materials, health care, energy, and staples, emphasizing the importance of macroeconomic signals like GDP.

While sector rotation offers potential for outperformance, it is not foolproof. Economic cycles can be unpredictable, and even seasoned experts may identify inflection points only in hindsight. The strategy demands active monitoring, making it unsuitable for investors seeking a truly hands-off approach.

Additionally, during severe market downturns, most sectors may decline in unison, limiting the protective benefit of rotation. Thus, positioning should be tempered with risk management tools such as stop-loss orders or portfolio diversification.

In mid-2025, the S&P 500 experienced a modest decline driven by weakness in mega-cap technology stocks. However, roughly 75% of the underlying components advanced as investors rotated into defensive and cyclical sectors.

Materials and energy stocks saw renewed interest amid rising commodity prices, while health care and consumer staples offered shelter from volatility. This real-world example underscores how timely rotation can capture returns even when headline indices stumble.

Research dating back to 1854 by the National Bureau of Economic Research confirms historical consistency across market cycles. While cycles vary in duration, patterns of sector leadership endure over decades.

Academic studies and industry analyses demonstrate that investors who rotate sectors based on business cycle signals have historically outperformed passive benchmarks on a risk-adjusted basis. These insights have led many institutional investors to allocate to sector rotation funds or incorporate sector signals into multi-asset portfolios.

Sector rotation represents a powerful tool in the investor’s arsenal, enabling more dynamic portfolio management that aligns with the evolving economy. By mastering the interplay between macro trends and sector performance, one can seek out enhanced returns through strategic allocation.

While no method guarantees success, a disciplined approach grounded in thorough research, robust metrics, and regular rebalancing can help investors navigate market cycles with greater confidence.

As market environments shift, those who understand the art and science of sector rotation will be better equipped to identify and capitalize on emerging opportunities.

References